The Internal Revenue Service (IRS ) is continuing to promote awareness of the impact of the Tax Cuts and Jobs Act that went into effect in late December, 2017.

The effort includes a new series of plain language Tax Tips, a YouTube video series and other special efforts to help people understand the importance of checking their withholding as soon as possible.

What is a "Paycheck Checkup"

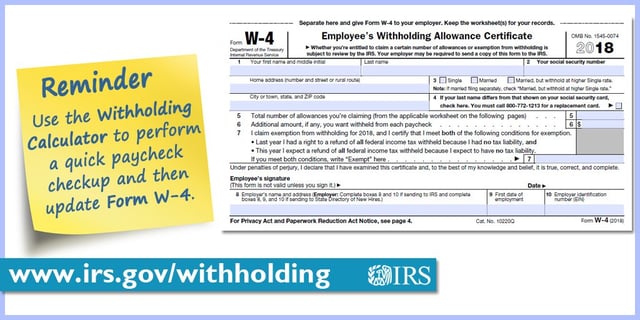

The IRS has released an updated version of Form W-4 (Employee's Withholding Allowance Certificate) and its online withholding calculator. These tools allow taxpayers to check their 2018 tax withholding following passage of the Tax Cuts and Jobs Act.

The IRS is encouraging all employees to perform a quick "paycheck checkup" using it’s newly revised withholding calculator to verify tax is being withheld from their paychecks.

Who Needs a Paycheck Checkup

The IRS always recommends employees check their withholding at the beginning of each year or when their personal circumstances change to make sure they’re having the right amount of tax withheld from their paychecks. With the new tax law changes, it’s especially important for certain people to use the Withholding Calculator on IRS.gov to make sure they have the right amount of withholding. Among the groups who should check their withholding are:- Two-income families

- People working two or more jobs or who only work for part of the year.

- People with children who claim credits such as the Child Tax Credit.

- People with older dependents, including children age 17 or older.

- People who itemized deductions in 2017.

- People with high incomes and more complex tax returns.

- People with large tax refunds or large tax bills for 2017.

The law increased the standard deduction, removed personal exemptions, increased the child tax credit, limited or discontinued certain deductions and changed the tax rates and brackets. When personal circumstances change that reduce withholding allowances they are entitled to claim, including divorce, starting a second job, or a child no longer being a dependent, an employee has 10 days to submit a new Form W-4 to their employer claiming the proper number of withholding allowances.

What Employers Should Do

In short, help Get the Word Out. Taxes are in the forefront for most employees during the first quarter of each year. Help employees prevent unexpected surprises by leveraging the IRS's efforts to to remind employees of the tools and resources that are available to them by joining the IRS Social Media Efforts, and Issuing a notice to your employees.

Join the IRS Social Media Efforts

in support of a Thunderclap campaign promoting a national “Paycheck Checkup.” Thunderclap is a social media platform that will automatically post a message to participants’ Facebook, Twitter or Tumblr accounts to support an initiative. To sign up for the Paycheck Checkup Thunderclap:

1. Follow this link: http://thndr.me/7BvGKI. Select “Support with: Facebook | Twitter | Tumblr.” (Choose one, then repeat the process to select more platforms or a second account.)

2. Authorize Thunderclap to post a single message by clicking on the “Add My Support” tab, and following the prompts to input username and password.

On Thursday, March 29, at 2 p.m. EST, Thunderclap will automatically post, “IRS urges you to perform a Paycheck Checkup today to make sure your tax withholding is right for you. http://thndr.me/TRRWef” to all participating social media accounts. The link goes to the recently updated IRS Withholding Calculator.

Issue a Notice to Your Employees

Use the following example notices and post an employee announcement to your intranet, HCM system, internal message boards, and email programs.

Employee Notice Example #1

(copy and paste to use)

Employee Notice Example #2

(copy and paste to use)

Learn what you need to know about withholding, the Withholding Calculator and filling out a new Form W-4, by watching these IRS YouTube videos:

Paycheck Checkup| IRS Withholding Calculator Tips | Do I Need to Fill Out a New W-4?

Employee Notice Example #3

(copy and paste to use)

What’s Next

The IRS anticipates making further withholding changes for 2019 and will work with businesses and the tax and payroll communities to implement these changes and have confirmed that they will release 2019 W-4 in the summer months to give employees and employers plenty of time to plan and prepare.